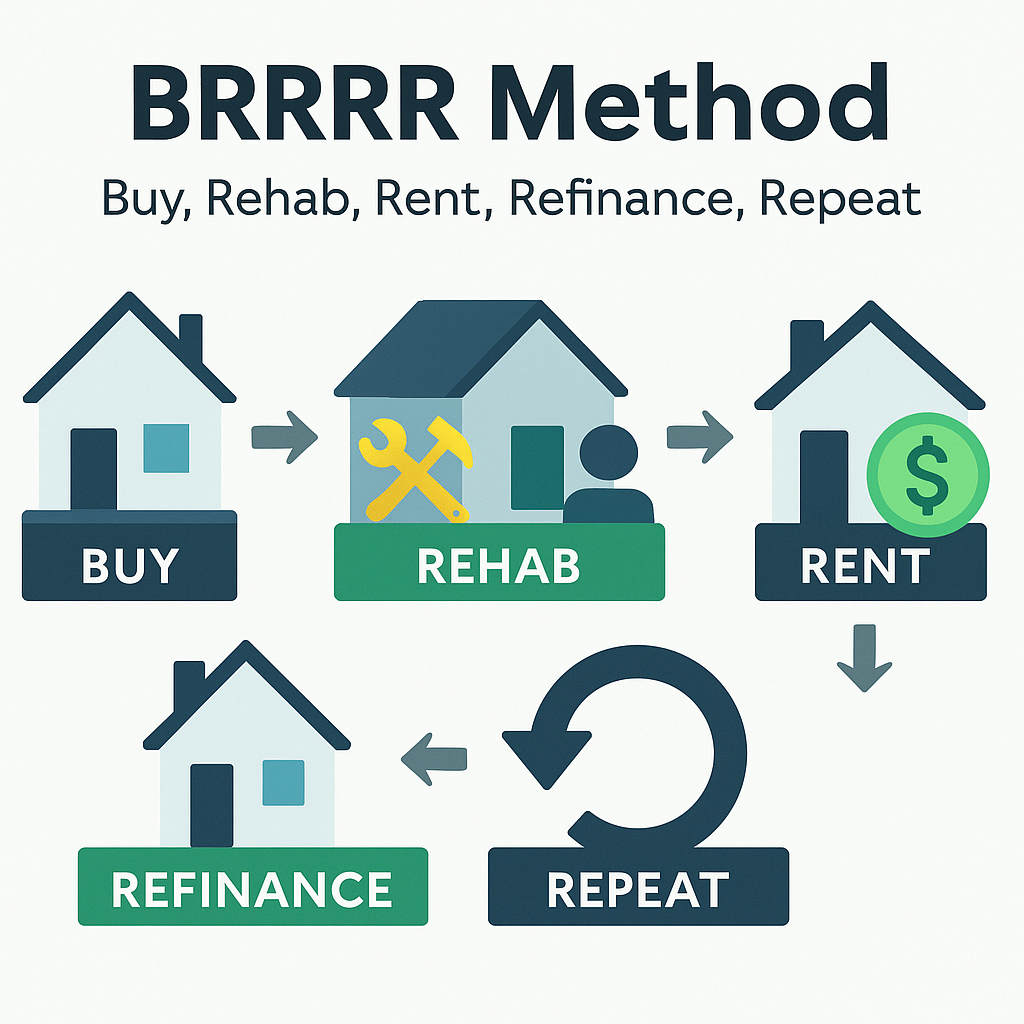

BRRRR Real-Estate: Buy → Rehab → Rent → Refi → Repeat

Recycle your capital, multiply cash-flow and build a rental empire without

draining savings. I’ll guide you through each BRRRR step—analysis, rehab,

tenanting and cash-out refinance—so you can Repeat on autopilot.

BRRRR is the recycler’s playbook for scaling rentals with minimal out-of-pocket

cash. Acquire a discounted property, force appreciation through renovation,

stabilize with a quality tenant, then refinance to pull out most—sometimes

all—of your original capital. With funds back in hand, you repeat the cycle,

compounding equity and passive income. My role: accurate COR analysis, lender

seasoning guidance, and tight project oversight so refi proceeds meet

expectations.

Five-Step Path to Capital Recycle

- Buy — Target 70–75 % of ARV minus rehab budget.

- Rehab — Tenant-friendly, value-add updates that boost appraisal.

- Rent — Screen tenants; lock market or premium rents for DSCR.

- Refi — Cash-out at 75–80 % LTV; recover 90–100 % of capital.

- Repeat — Deploy recycled funds into the next deal within 60–90 days.

Typical Performance Benchmarks

• Capital recycled at refi: 85–100 %

• Post-refi cash-flow: $250–$450 / door

• Additional equity return: 6–8 % / year

• Holding period to refinance: 3–12 months

Why Partner with Me

- Full Deal Analysis — ARV comps, rehab line-items, DSCR stress tests.

- Trusted Lender Bench — DSCR & portfolio lenders comfortable with 90-day seasonings.

- Contractor Oversight — Weekly progress reports, draw management, change-order control.

- Exit Flexibility — Flip or wholesale backup if refi terms shift.

- Repeatability — Templates for bookkeeping, rent-roll tracking & scalable systems.

BRRRR Cycle Walk-Through

Risk Disclaimer: Past performance is not a guarantee of future

results. Loan terms, appraisal values, and market conditions can affect refi

proceeds. Perform independent due diligence before investing.

Recycle Your Capital—Scale Faster

Let’s analyse a live BRRRR lead and craft your step-by-step plan.

Explore More Strategies

Fix & Flip – Rapid $30–80 K profit spreads in 3-6 months.

Passive & Vacation Rentals – Long-term cash-flow plus six-figure Airbnb upside.

Funding Solutions – Hard-money, DSCR and private-lending options tailored to each deal.

Frequently Asked Questions

How do I estimate rehab costs quickly?

Start with a cost-per-square-foot baseline from local contractors, then adjust

for major systems (roof, HVAC, plumbing, electrical). Add a 10–15 % contingency

for surprise items discovered during demo.

What financing options fit first-time investors?

Popular choices include hard-money loans (higher rates, quick close), DSCR

rental loans (based on cash-flow, not personal income) and low-down conventional

investor loans for those with strong credit.

How do I choose between long-term and short-term rentals?

Long-term rentals = steady income & less management; short-term rentals

(Airbnb) = higher gross revenue but require active or professional management

and local STR compliance. We’ll run both pro-formas before you buy.

What closing costs should I expect on an investment purchase?

Budget 3–5 % of purchase price for lender fees, title insurance, escrows and

transfer taxes. Hard-money points and interest are in addition to these costs.

Mini Case Study

| Metric | Value |

|---|---|

| Purchase Price | $250,000 |

| Rehab Budget | $40,000 |

| After-Repair Value (ARV) | $350,000 |

| Cash-Out Refi Proceeds (75 % LTV) | $262,500 |

| Cash Recycled | ≈ 90 % |

| Monthly Cash-Flow (post-refi) | $350 |

Glossary – Key Terms

ARV •

DSCR •

LTV •

Cap Rate •

ADR

Click any term for a quick definition or deep-dive article.